Written By: Stephen Reisler

It may seem counterintuitive to joke about throwing in the towel with the business success you’ve enjoyed thus far, but the truth is that not every business is able to succeed forever. So many business owners seek the advice of others on how to try harder, work smarter, or to do things differently in order that their businesses remain resilient and are more relevant.

Stephen Reisler, BusinessExit.com

What happens to your business tomorrow if something were to happen to you today? Life happens and we cannot stop it – accidents, sickness, disease, and death happens daily. None of us are protected against ‘life’ but you can take the necessary steps to protect the business by creating a documented CONTINUITY PLAN.

Written By: Teresa Shefer- BusinessExit.com

Business owners who are considering exiting their businesses within the next 5 years should become acquainted with the Offering Memorandum. The OM, also known by other industry names, is a data rich marketing document designed to highlight your company’s positive attributes to a prospective buyer. Businesses are rarely sold without the exchange and review of the OM or a version of it.

Ronen Shefer, BusinessExit.com

Ask yourself this question; If you decided to take six months off from the business – as opposed to the old “what happen if you get hit by a bus” question – can your business survive without you for an extended period of time? If your answer is Yes, congratulations! You have achieved something most business owners only dream about. If your answer is No however, you should consider implementing strategies to lessen the business dependency on you.

The following is an edited excerpt from the book, Buying Out the Boss: The Successor’s Guide to Succession Planning, by Michael Vann and Kevin Vann.

Ronen Shefer, BusinessExit.com

50% of business fail within the first 5 years of business and less than 1/3 of businesses survive 10 years+. Many of these companies failed simply due to their inability to juggle multiple areas of their businesses at once. The dropping of the ball when it comes to financial planning and monitoring, marketing, staffing, inventory management, order processing, customer mining and acquisition, billing, to only name a few, can be devastating to a company’s vitality.

Terry Shepherd, BusinessExit.com

Your business sale is imminent and due diligence is about to begin. For you to stay on after the transaction with either a continued stock interest, an earn out agreement based on reaching revenue milestones post transaction, or some other financial incentive, work is required from you and the buyer leading up to the sale, to make sure it is the right fit and to help ensure its success.

Terry Shepherd, BusinessExit.com

According to Chris George from George & Company, an intermediary located in Worcester, less than 10 percent of business owners who contact his company have sufficiently planned ahead. The contact is usually spurred by an event, such as death, illness, partner disagreement, etc. His experience is pretty consistent with national surveys our company has conducted over the years.

Are you finally pushing profit margins into the green? Great! But do not jump on the expansion wagon just yet… Take a breather, reassess and make sure that your business ticks the boxes (or at least most of them) that signal you are ready for growth.

Doug Hyland, BusinessExit.com

John got a call from one of his biggest customers. They had been in the process of putting together a large order that John thought would be his most important piece of business for the year. It was a fair deal – both sides would benefit. The customer was calling to advise that they were not going to proceed with the order. John was stunned. Almost too surprised to even ask “Why”?… What he heard surprised him even further!

Source: Boston Business Journal

Written by: Bob House

After consecutive months of steady growth, the BizBuySell Q4 2016 Insight report revealed a record 7,842 closed small-business transactions were reported in 2016, the highest yearly total of small- business sales since BizBuySell first started tracking data in 2007.

Source: BusinessZone.co.uk

Written By: Christian Annesley

In February this year the serial entrepreneur Mark Mason finalized terms to sell his app-development business, Mubaloo, to a media agencies group wanting to diversify. Here are his eight tips on delivering the right exit based on his own experience

Terry Shepherd, BusinessExit.com

Baby boomers…the generation born between 1945 to 1964 were originally defined because of the peak birth rates that resulted from the men returning home from WWII after their long absence. Since their birth, they have supercharged the economy by their unprecedented shear numbers, creating huge waves of demand and opportunity.

Source: Milwaukee Journal Sentinel

Westgate is scouring the market to buy a manufacturing company, preferably one based in Wisconsin. So, what can a company owner do to make a firm more attractive to a financial or strategic buyer? I asked Westgate to provide his advice for C-Level executives eager to make their company more attractive acquisition targets.

Stephen Reisler, BusinessExit.com

You should know that I am an active wine collector, and am always looking for great buying opportunities. And, you won’t believe where I am now finding the best buying opportunities for 2016. Just north of the border, in Canada!

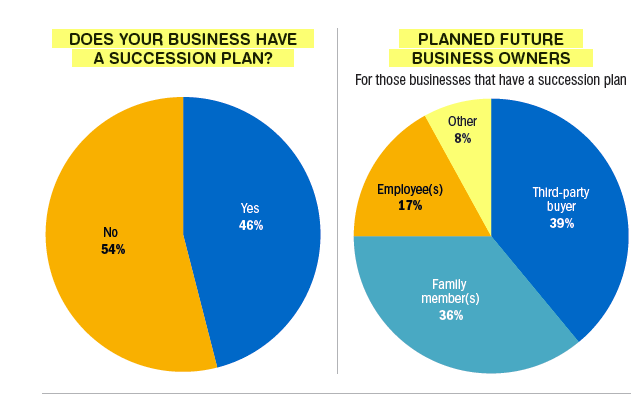

Source: Boating Industry

Just less than half of marine industry companies have a succession plan or exit strategy for their business. That’s according to the latest survey of Boating Industry print and digital subscribers, conducted by email in March and April.

When is the last time you reflected on why you started your business?

Was it for a stream of income to provide for your family? Or was it also about building a business that created a value that you’d cash out on one day? To be able to do that and to maximize the value you’ll receive, you’ll need a sustainable business model to pass along. It’s all set up in your business plan. I have a special approach for my clients that makes a huge difference to the sale price of their business.

© BusinessExit.com, LLC. All Rights Reserved.

Website Design by IWD Marketing.